How to Leave Money to Charity in Your Will: A Step-by-Step Guide

Leaving money to charity in your will is one of the most impactful ways to support causes you care about while creating a lasting legacy. Whether it’s education, healthcare, or environmental conservation, your generosity can continue to make a difference long after you’re gone.

Including charitable donations in your estate plan isn’t just about giving. It’s also about ensuring your values are reflected in how your assets are distributed. If you’re unsure where to start, explore our guide on how to simplify the probate process for your heirs or learn about how to protect your pets in your estate plan. Along the way, we’ll reference authoritative resources to help you create a plan that truly reflects your wishes.

Taking the time to plan your charitable legacy today means knowing your contributions will continue to inspire change tomorrow.

Why Leave Money to Charity in Your Will?

Beyond the emotional satisfaction, there are practical benefits as well. For example, charitable donations can reduce estate taxes, leaving more of your assets available for your loved ones. Additionally, leaving a legacy of generosity can inspire others to follow in your footsteps.

Consider this: A colleague left a portion of her estate to a local animal shelter, ensuring her love for animals continued even after she was gone. Resources like Charity Navigator provide valuable insights into verifying charities and understanding their impact.

By planning for charitable donations today, you can create a meaningful legacy that reflects your values and makes a lasting difference.

Ways to Leave Money to Charity in Your Will

Specific Bequests

Leave a specific dollar amount or asset (such as stocks, property, or valuable items) to a charity. This is straightforward and ensures the charity receives exactly what you intend.

Example: "I left $5,000 to my favorite education nonprofit in my will."

Residuary Bequests

Donate a percentage of your remaining estate after debts, taxes, and other gifts are paid. This is a flexible option that adjusts based on the size of your estate.

Example: "I allocated 10% of my residuary estate to a global health organization."

Contingent Bequests

Specify that a charity receives assets only if certain conditions are met, such as primary beneficiaries predeceasing you. This ensures your wishes are honored even in unexpected circumstances.

Charitable Trusts

Set up a charitable remainder trust (CRT) or charitable lead trust (CLT) for more complex arrangements. These allow you to donate while potentially receiving tax benefits or income during your lifetime.

For example, after identifying my favorite environmental nonprofit, I included a clause in my will leaving them 10% of my residuary estate. Resources like EstatePlanning.com provide detailed guidance on these options.

By choosing the method that aligns with your goals, you can ensure your generosity benefits both the causes you care about and your overall estate plan.

Step-by-Step Guide to Leaving Money to Charity in Your Will

Identify the Causes You Care About

Reflect on the charities or causes that matter most to you. Whether it’s education, healthcare, environmental conservation, or social justice, choosing organizations that align with your values ensures your legacy reflects your passions.

Research the Charity

Ensure the organization is legitimate and eligible to receive donations. Use tools like Charity Navigator to verify their status and understand their impact. Double-check the charity’s full legal name to avoid confusion during the distribution of your estate.

Decide on the Type of Gift

Choose the type of donation that works best for your situation. Options include specific bequests (a set amount or asset), residuary bequests (a percentage of your estate), contingent bequests (conditional gifts), or charitable trusts (for more complex arrangements).

Include Clear Instructions in Your Will

Work with an attorney or use a trusted template to add a clause specifying your charitable donation. Be clear about the amount, percentage, or asset being donated, as well as the charity’s full legal name.

Communicate Your Wishes

Share your intentions with family members or beneficiaries to avoid surprises later. Clear communication ensures everyone understands your decision and its importance to you.

Review and Update Regularly

Revisit your will periodically to ensure it reflects your current wishes and circumstances. For example, if your financial situation changes or you discover a new cause you’re passionate about, update your charitable bequests accordingly.

For example, after identifying my favorite environmental nonprofit, I included a clause in my will leaving them 10% of my residuary estate. Resources like Nolo provide detailed guidance on drafting these clauses.

By following these steps, you can create a clear, actionable plan that ensures your generosity continues to make a difference.

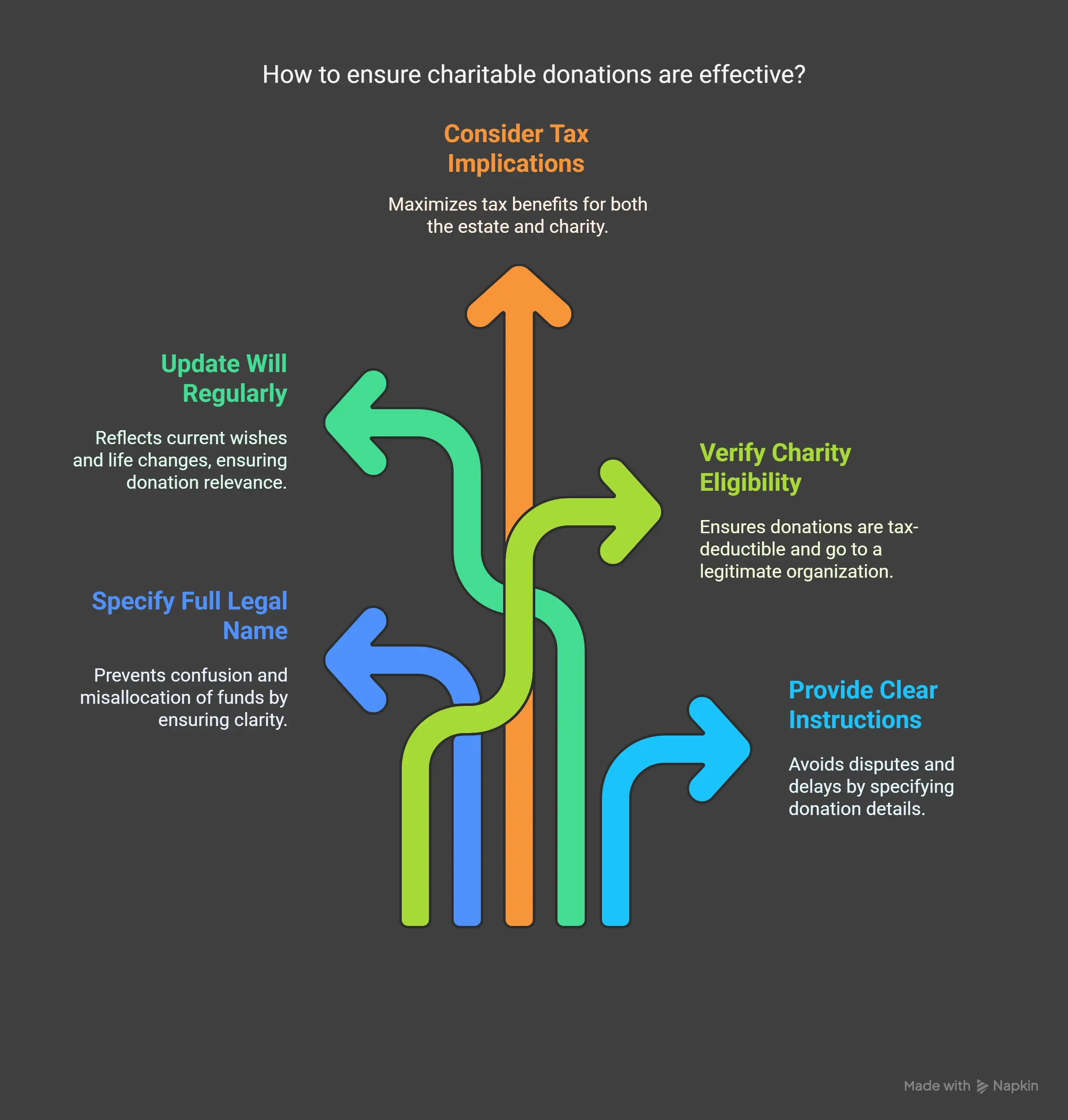

Mistakes to Avoid When Leaving Money to Charity

Failing to Specify the Charity’s Full Legal Name

Using a charity’s shorthand name or nickname can lead to confusion or misallocation of funds. Always include the organization’s full legal name to ensure clarity.

Not Updating Your Will After Changes

Life circumstances and charitable priorities can change over time. Failing to update your will means your donation may no longer reflect your current wishes.

Overlooking Tax Implications

Charitable donations can reduce estate taxes, but only if they’re structured correctly. Consult with an estate planning professional to maximize the benefits for both your estate and the charity.

Ignoring the Charity’s Eligibility Status

Ensure the organization is eligible to receive tax-deductible donations. Tools like Charity Navigator can help verify their status.

Being Too Vague in Your Instructions

Ambiguous language can lead to disputes or delays in distributing your assets. Be specific about the amount, percentage, or asset you’re donating, as well as the charity’s details.

For example, a friend intended to leave money to a local food bank but forgot to update his will after the organization changed its name—resulting in delays and confusion. By avoiding these mistakes, you can ensure your donation is handled exactly as you envision.

Conclusion

Leaving money to charity in your will is a powerful way to support causes you care about and create a lasting legacy. By identifying the right organizations, choosing the type of gift that aligns with your goals, and including clear instructions in your will, you can ensure your generosity continues to make an impact.

Taking the time to plan your charitable legacy today means knowing your contributions will inspire change tomorrow. Start planning your donations today and check out our guide on What Happens If You Die Without a Will for more insights.

Next, learn how to avoid probate with a revocable living trust and protect your estate for future generations. With these steps, you can create an estate plan that truly reflects your values and priorities.

Have questions or experiences with leaving money to charity in your will? Share in the comments below or sign up for our newsletter for monthly estate planning tips.

Post a Comment